SOLVED:Describe the two parts of an account number

At one time, account numbers were the state of the art in securing and authenticating financial accounts. But increasingly, especially when compared with other technologies, they have become a source of errors, friction, and fraud. The exception to the above rules is American Express, whose cards have only 15 digits.

This article will examine the precise origins and significance of these numbers. I will discuss how to locate them and the distinctions among frequently used numbers, including account, routing, and credit-card numbers. Someone in possession of your account number and your password or pin number can access your account and then authorize payments or withdrawals from it. Like looking up the address of a hotel, anyone who wants to find the routing number for a specific bank can simply locate it online.

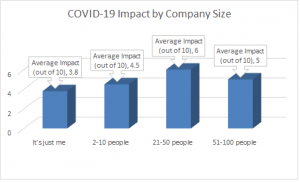

Digit Chart of Accounts Numbering System

If you can’t find it in these ways, try visiting a bank branch in person. A bank account number is a unique string of numbers and, sometimes, letters and other characters that identify a particular bank account and grant access to it. This often is one of the most important account numbers describe the two parts of an account number people have for transacting business. The former identifies your bank account, while the latter is specific to your credit card. An account number identifies your individual account, while a routing number (or sort code in some countries) identifies your specific bank branch.

A SWIFT (Society for Worldwide Interbank Financial Telecommunication) code is an alphanumeric string of 8 to 11 characters that SWIFT uses to identify financial institutions. Each institution has a unique code, which is also referred to as its bank identifier code (BIC) or ISO 9362 code. Every bank-related financial transaction requires a routing number and an account number. Each account in a general ledger chart of accounts is allocated a code depending on the chart of accounts numbering system used by a business. In the United States, the routing number is nine digits long, proving that the designated financial institution has an account with the Federal Reserve and is state or federally chartered. Clients can have several accounts, each with its own account number, although the routing number (the financial institution that maintains the customer’s account) stays the same.

How Do I Find My Routing Number and Account Number?

Anyone can locate a bank’s routing number, but your account number is unique to you, so it is important to guard it, just as you would your Social Security number or PIN code. The traditional check layout applies to most personal checks, but some business checks and bank-printed checks have other formats. If you have questions about connecting your financial accounts to a Plaid-powered app, visit our consumer help center for more information.

Leave a Reply